Friday Highlight Reel: Edition #2

A sampling of interesting observations from the Haymaker's network of market experts and favorite resources.

Image: Shutterstock (modified)

“If your deficit projection starts to get out of control and your real interest rates start to rise rapidly, you can into a kind of doom loop. We’re going to need to be watching our own fiscal projections in the United States very carefully.” -Larry Summer, former U.S. Treasury Secretary

Editor’s Note

Well, the verdict reached us quickly and positively — you, our wonderful readers, like the Highlight Reel format. And that’s really something, because we like creating it. In fact, we like creating it so much that it will now be our standard format for most Friday editions. As Dave has mentioned, he plans to produce a long-form Haymaker post on occasion, but our Making Hay Monday editions will cover most of his market-centric, high-finance, and geo-economic topics from week to week.

Haymaker is a work that remains in progress. Your input as our subscribers will be of help as we further refine the newsletter to meet reader expectations. Don’t be shy in offering as much of that input as you like. We really do welcome it and will always be grateful to absorb it.

With sincere appreciation,

-Mark Joseph Mongilutz

#1: Dalio in Barron’s

Ray Dalio’s success on Wall Street is legendary. Moreover, no one can derisively ask him: “Where are your customers’ yachts?” His firm, Bridgewater and Associates, has made its clients boatloads of money. Its mainstay Pure Alpha fund was up 9.5% in 2022, truly remarkable based on 2022’s inhospitable market conditions. Its long-term track record is also extraordinary, having produced roughly a 12% per year net return since its inception in 1991. The S&P has returned about 10% annually since then and with far more volatility. Ray is now 74 and is stepping back from the daily grind but his insights are still worthy of your consideration.

Ray Dalio (as excerpted from a Barron’s interview late last year): “The Fed’s selling of debt assets will be accompanied by other sellers of debt, creating too many sellers of det assets relative to buyers. To make the supply and demand balance, private credit will have to contract which will weaken the economy…When the next big downturn occurs, and the economic pain is greater than the inflation pain, you will see the Fed and other central banks continue money-printing so monetize debt.”

Image: Wikimedia Commons

Haymaker Take: That’s about as concise a summation of the overall situation — and eventual monetary response — as I think can be offered up. First, a big downturn and then, second, a radical 180° by central bankers to keep the system from crashing. From listening extensively to Bridgewater’s co-CIO, Greg Jensen, I know he feels the “big downturn” is just over the horizon. He’s also talking economically, not just about financial markets.

#2. Jefferies on M2

Jefferies’ Chris Wood and his weekly Greed and Fear missives are another of my regular reads. He wrote this week on the changes among Fed-heads, with Vice Chair Lael Brainard being picked to run the Biden administration’s National Economic Council. In his view this has important implications for monetary policy. Ms. Brainard has a dovish reputation and, apparently, there was no love lost between her and Jay Powell.

Chris Wood: “In this context, Brainard’s departure may give Powell more room for manoeuvre to play his current wannabe Volcker act before he does the inevitable pivot. In this respect, the story remains that Powell wants to avoid going down as the Arthur Burns of this inflation cycle. So far as GREED & fear is concerned, Powell will inevitably be seen in the eyes of history as the Arthur Burns of this cycle as he presided in the spring of 2020 over the biggest expansion of M2 growth since the monthly data series began in 1959. In that respect, his fate is sealed. With M2 growth now collapsing in a way which is beginning to look on the chart like the mirror image of what happened in 2020 but in the reverse (see Exhibit 6), the risk is that he could also become the Herbert Hoover of this cycle.”

Chart: Jefferies

Haymaker Take: One of our observant readers pointed out, with regard to a similar money supply chart we ran in Making Hay Monday recently, that the recent plunge in the money supply still hadn’t removed all of the excess liquidity created during the Fed’s frenzied pandemic response. It’s a fair point. However, the trend is nonetheless precipitous and I think a solid case can be made for the rate of change being as important as the overall stock of money, perhaps more so. The venerable Lacy Hunt concurs with that view. He further notes that his preferred money measure, Other Deposit Liabilities (of commercial banks, or ODL), has fallen at the steepest rate in history from 2021’s fourth quarter through the end of 2022. He also points out that money velocity is declining, as well. He believes recession risks will become more apparent later this year.

#3: The Office of (Mis)Management and Budget (The Hill)

This week the Office of Management and Budget (OMB) increased its fiscal year 2023’s federal deficit estimate by $400 billion, to $1.4 trillion. It also projects the U.S. government’s red ink to average $2 trillion per year this decade.

Headline: The Hill

Haymaker Take: The OMB’s 2023 forecast is a shocking number with the official unemployment rate at the lowest since 1969. Government revenues are not the problem. They have been running above the 50-year average as a percentage of GDP. The problem, as usual, is spending, which is running about 4% of GDP above the mean since 1972 (that’s a cool $1.2 trillion or so). The OMB is forecasting that in a decade the annual deficit will be $2.7 trillion. Even worse, it appears to be underestimating interest costs and overestimating economic growth.

#4: Jim Reid Talks Debt

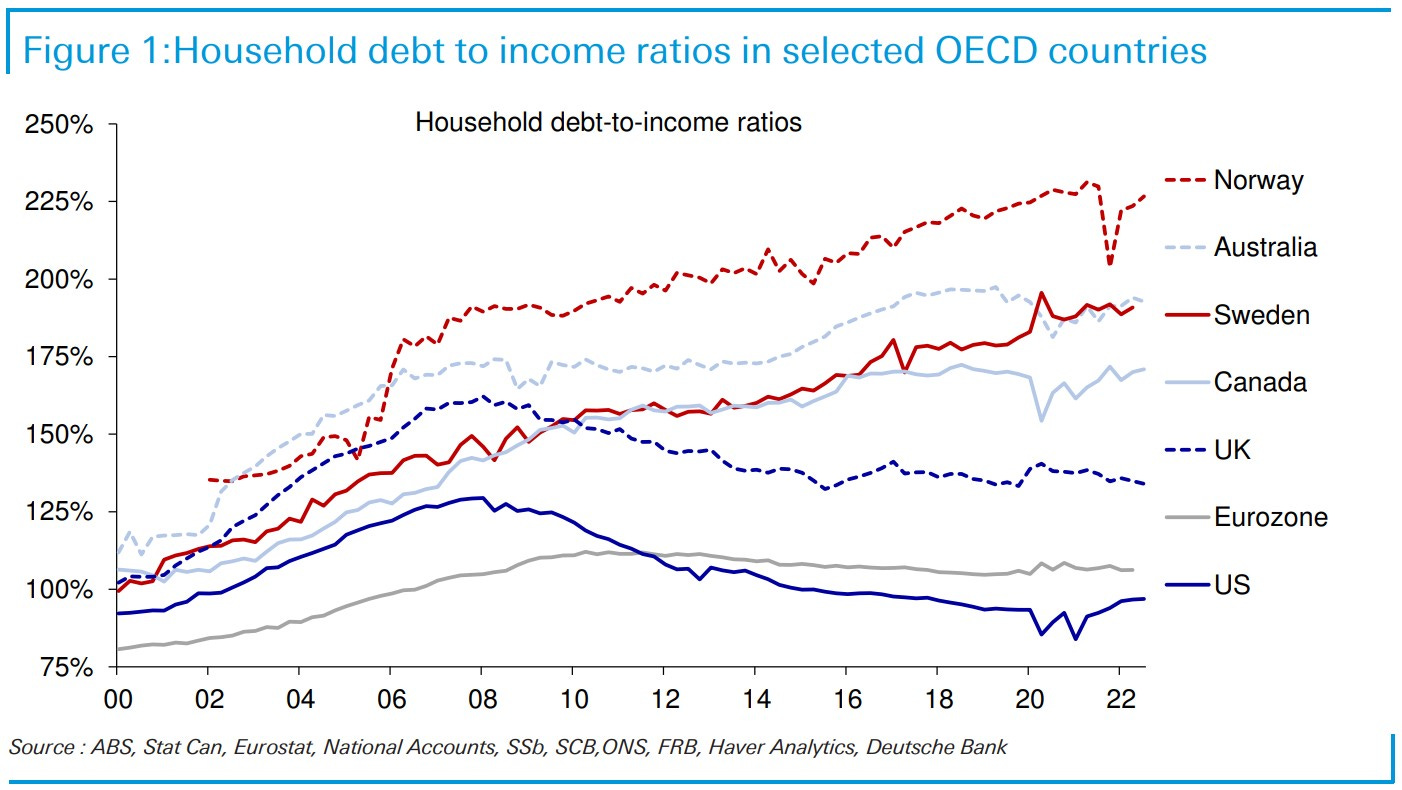

How about some good news on debt? Per Deutsche Bank’s Jim Reid, whose Daily is one of my favorite early-morning reads (must-read Reid?), several other developed world countries are far more in hock than the U.S., at least at the household level. However, DB also recently ran the second chart illustrating how badly the federal government debt situation has deteriorated from what was anticipated nearly 15 years ago.

Chart: Deutsche Bank

Chart: Deutsche Bank

Haymaker Take: What the upper chart essentially illustrates is the amount of debt taken on by the citizens of countries that have experience monstrous housing bubbles. It’s a distinct positive that the U.S. is in far better shape in this regard. Unfortunately, though, our profligate government largely offsets that attribute. For example, Canada’s government debt is just 71% of GDP, not closer to 115% as it is in the U.S. (including treasuries held by the Social Security and Medicare Trust Funds). In America, federal red ink is projected to run at WWII levels relative to the size of the economy throughout this decade.

#5. Pippa Malmgren on WWIII & Sky Lanterns

Pippa Malmgren is the daughter of Harold Malmgren who has been closely tracking the machinations in Washington, D.C. as far back as the Cuban Missile Crisis. Her Pippa’s Pen & Podcast service is continuing her father’s tradition of unique and insightful geopolitical analysis. As with the Haymaker, Substack is her medium of choice. (Interestingly, this is also the channel that Seymour Hersh used to launch his bombshell article alleging the Biden Administration ordered the destruction of the Nord Stream 1 and 2 Pipelines.) Even prior to Russia’s invasion of Ukraine, she has been warning about a covert WWIII.

Here is how Pippa ended her February 6th Substack post Sky Lanterns, Fu-Go Wind Ships, Drones, Balloon Bombs and the Markets: “It’s not that the balloons are a threat. It’s that they create chaos in the decision-making apparatus, and that’s very valuable. They also can be used to create diplomatic incidents, which also have value in wartime. Head fakes are part of the negotiation process. So, we can expect the US to lash back?…Can the West keep cutting off China and expect no response? Can China keep taunting the US and expect no response? The markets won’t like all this. This is The Invisible War that we occasionally get brief glimpses of. China’s Sky Lanterns illuminated this fact.”

Headline: Malmgren

Haymaker Take: By “Sky Lanterns” she’s drawing a connection between the explosive-laden “wind-ships”, called Fu-Go Bombs, Japan launched into America during WWII and the recent mysterious Chinese balloon incident. Among other ramifications, it did expose serious weakness in the NORAD warning system. In my semi-paranoid mind, it raised worries about a more sophisticated craft coming into U.S. airspace and detonating a nuclear device at an altitude that would fry the U.S. electrical grid. This could bring down the internet and seriously hobble our military preparedness.

#6: Doomberg on East Palestine and the Railways

Friend of the Haymaker, Doomberg, has published a much-needed and detail-dense article on the recent rail disaster that has horrifically befallen the residents of East Palestine, Ohio. The piece, which we strongly advise you read in its entirety, is a substantive counterweight to the broader media’s confusing coverage to date. Take this excerpt:

“There are many well-documented reasons to question communications issued from government agencies these days – and the widespread alarm over the incident lays bare the chronic stress such distrust lets simmer under the surface for much of the population. If we have earned any credibility with our readership over these last two years of publication, please take this to heart: residents of Mississippi need not stock up on bottled water, at least not because of this.

That is not to say there isn’t a cause for nationwide upset here. As we will detail in a future piece, this incident demands a much-needed light be shined on the scandalous state of the US rail industry. That we even allow vinyl chloride to be shipped in this fashion is unnecessary and unacceptable. As few are aware, there are other, even more, dangerous materials on trains passing by residential neighborhoods every single day. It would take but a few simple rule changes to chemical industry regulation to alleviate much of this risk.“

Haymaker Take: Residentially proximate catastrophes such as the one East Palestine is regrettably struggling with are also the sort that can evoke indiscriminate or even counterproductive outrage from sympathetic observers. As much scorn as is due (and we won’t argue that there’s plenty), this is also a moment for careful scrutiny and a policy-focused mentality, one that will lead us towards sensible reform and away from any such system that can inflict such terrible harm on unsuspecting citizens.

On the topic of reforms, this event does call into question the U.S. railroad industry’s relentless pursuit of cost reductions in the pursuit of higher profits. Specifically, Precision Scheduled Railroading has allowed this industry to realize an earnings explosion over the last decade. When it’s the rail cars themselves that start exploding, though, it’s time for regulators to become much more assertive. This is another example of the supply chain having been over-optimized, rendering it dangerously fragile… as well as, outright dangerous.

#7: Jeffrey Sachs’ Recent UnHerd Interview

One of the strangest geopolitical episodes of the past year was surely the partial destruction of the Nord Stream pipelines. The act itself wasn’t strange (there is of course ample precedent for structural sabotage during wartime). What was strange was the Western media’s contorted (yet nearly unanimous) attempt to pin the attack on… Russia? As in Putin’s Russia, yes. Despite obvious strategic dividends for NATO and the United States — to say nothing for their destructive capacity to pull it off — somehow, Russia became the agreed upon culprit, with any evidence or arguments to the contrary angrily shouted down as the mouth noises of (God help us) Putin apologists and/or puppets.

One of those who suggested in the immediate aftermath that, indeed, the West itself might have been responsible for the attack was Jeffrey Sachs, who recently appeared with Freddie Sayers on the latter’s show UnHerd to take something of a victory lap. Said lap is owed to recent reporting by Seymour Hersh confirming much of what Sachs himself suspected from the outset. But we’ll let him tell you:

Haymaker Take: We don’t know any more than most other Americans about who issued the destruction order on Nord Stream, nor specifically how it was carried out. It does seem that Sachs’ instincts were correct, and also that there is a strong thread of credibility in Mr. Hersh’s reporting. What the two men are asking us to accept is hardly outlandish, certainly no more so than the possibility that Putin wanted to destroy gas Nord Stream rather than simply, you know, just stop the gas from flowing from its source… on his own land. Let us know your thoughts below.

And this bonus entry from The Babylon Bee…

I really like this format, it's handy and informative

A good cross-section of opinions. I look forward to reading your weekly highlight reel.