Friday Highlight Reel: Edition #1

A sampling of interesting observations from the Haymaker's network of market experts and favorite resources.

Image: Shutterstock (Modified)

“The top three investing skills are: patience, temperament, and having your career coincide with a 30-year uninterrupted decline in interest rates.” -Morgan Housel, author of the best-selling The Psychology of Money.

Launch Time… Once Again

Welcome to the Maiden Voyage of the newest Haymaker publication! Don’t worry, the Highlight Reel version won’t be additional content hitting your inbox. Rather, this will usually be in lieu of our full-length editions that go out on Friday. These are typically what we consider to be “Think” pieces, with reflections upon a variety of what we feel are important big-picture topics. A good example of that was last week’s issue, The Reckoning, Part II, concerning the non-trivial risk of serious dislocations in the U.S. treasury bond market this year.

The Highlight Reel is meant to be the photographic negative of that: A series of those items we have recently come across which we feel are particularly noteworthy. Our intent is to make this a slightly expanded version of The Wall Street Journal’s “What’s News” column on the left-hand side of each front page it runs. Consequently, it will be attractive to even the most time- and attention-challenged Haymaker reader. However, we’ll also generally provide our brief take on these snippets. (My plan is to continue writing in-depth notes, but more likely on a quarterly basis.)

Additionally, it has dawned on me lately that one of the most important benefits I can provide our readers is a sampling of the vast amount of research that comes my way. Between my firm, Evergreen Gavekal, and myself, we expend something north of $100,000 annually on research from various highly informed sources. It’s my belief that I can share more of that with you via this new format. Of course, only time will tell and you, good subscribers, will be decision-makers on whether I pull this off. We would appreciate your comments on this new effort. We’ll tweak it to conform as best we can with feedback we receive from multiple subscribers. (We will pay more attention to those who actually subscribe to our service versus those who are simply readers.)

With no further delay, here we go!

#1: George Noble

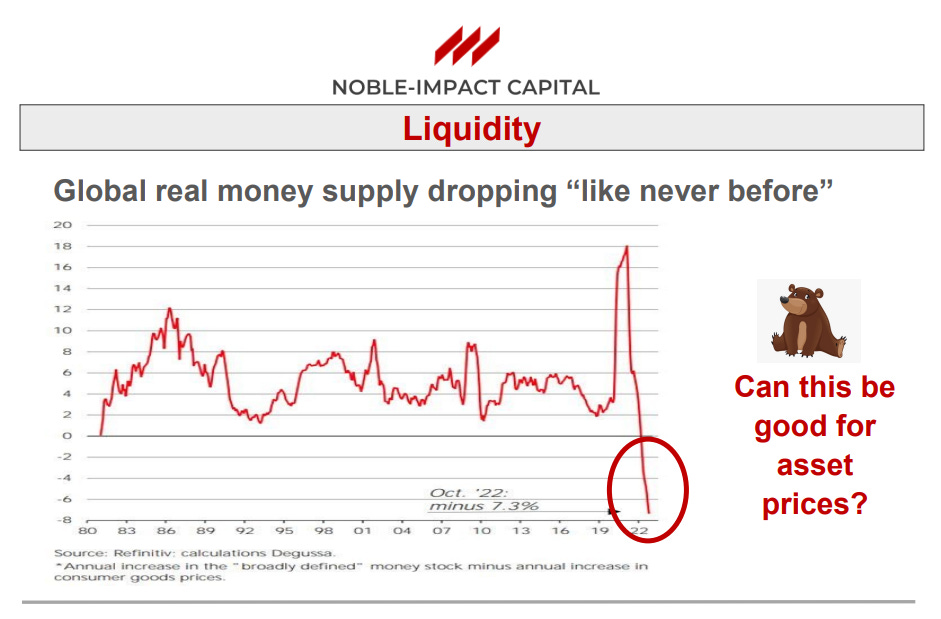

Chart: Noble

Haymaker Take: George Noble, a super-investor and gifted big-picture thinker, puts out some of the best visuals I receive. The above image is a classic example. The worldwide plunge in real, or inflation-adjusted, money supply is a screeching siren that something serious is amiss. To believe this won’t negatively impact asset prices – especially, the junk variety that have been leading the recent rally – seems to me naive in the extreme.

#2. David Rosenberg

David is a mainstay on CNBC and, almost unquestionably, Canada’s most famous economist. Here’s what he wrote this week on last Friday’s blockbuster jobs number:

“Instead of focusing on the payroll report, which was just one statistic for one month, perhaps we should be asking why it is that the level of full-time employment in the United States is lower today than it was last May. Not one full-time job has been created on net over this timespan.”

Haymaker Take: As I noted in this week’s Making Hay Monday edition, the supposed creation of over 500,000 new jobs reported a week ago was truly incredible – as in, hard to believe it was truly credible. What is a reality is that these releases are often revised, in some cases drastically. For example, the initial announcement that 1,047,000 new jobs were allegedly created in last year’s second quarter was revised down just a bit – like by 1,036,500! This synchs with the Philly Fed’s recent disclosure that by their calculations almost no new net jobs were created in the trailing 12 months. Neither of these received more than passing press coverage. The key takeaway: Be extremely skeptical of these initial reports that often create powerful market reactions.

#3. Danielle DiMartino Booth

Regular Haymaker readers know I’m a big fan of Quill Intelligence CEO Danielle DiMartino Booth, a former advisor to Dallas Fed president Richard Fisher. This was her recent analysis of the mounting evidence of a looming earnings recession:

“According to FactSet, fourth-quarter S&P 500 earnings growth have been revised down from a -3.3% decline at year-end 2022 to a -5.3% drop as of last week. The bigger news was that first-quarter earnings are now set to drop -4.2% (green bar) after expectations for a flat quarter about five weeks ago.”

Haymaker Take: Speaking of revisions, these are two others that have been largely ignored. Perhaps that’s because they don’t fit the prevailing market narrative of a soft landing. While that benign scenario remains a possibility with the economy, a profits recession looks increasingly like a slam dunk. Attention: Stock market shoppers!

#4: The Wall Street Journal

Here are two headlines from last Friday’s Wall Street Journal – the same day the stupendous jobs report came out – that call into question the accuracy of that number.

Headline Screenshots: WSJ

Haymaker Take: While the cost of a Wall Street Journal subscription has risen dramatically over the years, it still provides a great bang for the buck. Make that $5 bucks – the newstand price actually was $1.00 15 years ago. How’s that for some serious inflation? Don’t write the Bureau of Labor and Statistics. They’d no doubt explain it away with hedonics, if you did. (Hedonic adjustments lower the superficial inflation rate due to assumed quality enhancements.) One other datapoint that calls into question the soft-landing consensus view these days is that Americans are falling behind on their car payments at a higher rate than during the Great Recession. (Source: Bloomberg, 1/27/2023)

To learn more about Evergreen Gavekal, where the Haymaker himself serves as Co-CIO, click below.

#5: Luke Gromen

Another of my favorite sources, whom I often cite, is the author of Forest for the Trees, Luke Gromen. In his January 27th issue, he quoted Starwood CEO Barry Stenlicht from an appearance the latter made the day before on CNBC.

To wit, “And people who talk about raising rates, I hear (them) on your morning show, I want to strangle them. Volcker did not have a $32 trillion debt…So what Powell faces, if he keeps going up, you have the Weimar Republic–he has to keep printing US dollars to pay interest on the deficit, and you wind up printing and printing…”

Haymaker Take: Based on a steady stream of Fed commentary of late, there’s little doubt Powell & Co will continue raising rates. Hopefully, Mr. Sternlicht’s minions will prevent him from wrapping a rope around the neck of any Fed officials with whom he comes into contact. However, he has a point that higher rates could become self-defeating by blowing out the federal deficit. This runs the risk of overwhelming buyers of U.S. treasury debt and driving rates up during a recession. Such an outcome could force the Fed to restart its Magical Money Machine.

#6: Michael Hartnett

BofA Securities’ Michael Hartnett has become a must-read for me in recent years. In addition to having made a number of prescient market calls, he also regularly publishes fascinating charts. One of them is shown below, indicating greed is back in the market’s driver seat.

Chart: Hartnett

Haymaker Take: Greed might be driving the market into another Thelma & Louise-like cruise off a cliff. As you can see above, it’s extremely rare to have BBB-rated corporate debt yield essentially the same as 90-day T-bills. This is because the former has both credit and interest-rate risk, unlike short-term treasuries. Regardless, it is a reflection of extreme risk tolerance that, in the past, has consistently led to an unhappy outcome, sometimes of disastrous proportions.

Hope you enjoyed this Highlight Reel edition. Please comment below, share the piece, and if you haven’t yet done so, subscribe to the newsletter.

Great idea. I also like the additional commentary that fleshes out the thinking of each expert into a cogent and tidy package. This one's a winner, Sir!

Great content in right sized package