Friday Haymaker

In The Ring - September 22, 2023

Land of the Rising Yen, Part II

“How long can a country with 4% of the world’s population run budget deficits of 40% of the planet’s total and 60% of its trade deficit?” -Louis-Vincent Gave

“A nickel ain't worth a dime anymore.” -Yogi Berra

Currencies are relatively non-volatile, generally. In other words, it’s hard to make, or lose, much money holding them, unless you employ a hefty amount of leverage, such as with futures. Yet, every once in a while, an opportunity emerges that provides equity-like returns even without levering up. The Japanese yen presents exactly that type of opportunity, in my estimation.

Back on June 16th, I first wrote up the yen as a buy. Since then, it’s been a modest loser, down about 4%, after an initial (also modest) rise. Despite this, my faith in this as a long-term investment, not a trade, has strengthened. It’s true that most who play the currency game do so with a trading mindset, usually using futures contracts. (This excludes multinational companies, which use these vehicles to hedge their foreign exchange risk.) However, you don’t have to play the short-term game; in fact, yours truly has held some currency positions for years, also using futures.

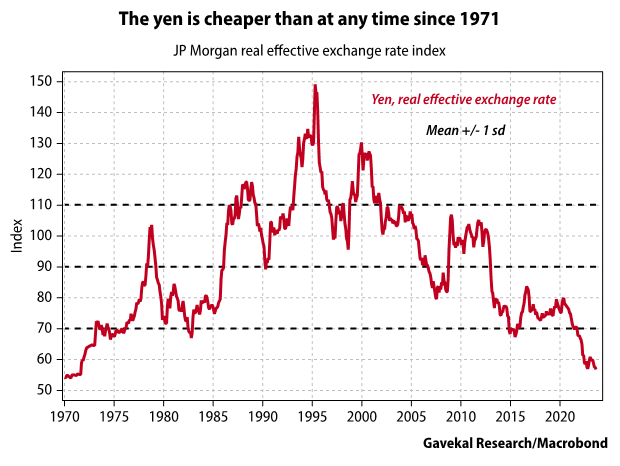

Typically, there is a drag or friction cost when you are rolling over futures contracts that are long a low-yielding currency like the yen. Based on the current wide spread between what U.S. T-bills are paying and short-rates in Japan, about 5½%, that’s a drag you should expect to incur. This is whether or not you use futures, which I’m sure nearly all Haymaker readers don’t (and won’t) do, or the ETFs that are out there on the yen. (The latter is a much more plausible way for retail investors to position for a higher yen.) In other words, should the yen stay flat versus the dollar over the next year, you’ll see about a 5½% loss, including on the ETF. In fact, presently, the futures’ market is implying a drag of about 10% over the next year. That’s definitely a negative for this opportunity, but I don’t think it’s a deal-killer based on the deeply undervalued condition of the yen. If a 50-year low on a real effective exchange rate (REER) basis doesn’t stimulate your contrarian juices, you might need to hold up a mirror to your nose.

REER vs USD

In the course of making my June plug of the yen, I put forth a possible near-term catalyst.

Here’s what I wrote:

For many years, the Bank of Japan (BOJ) has engaged in yield curve control (YCC). It has held the interest rate on 10-year Japanese government bonds (JGBs) at ½% or lower. Yet, like in most countries, inflation has been surging. Mind you, in a country that has had recurring bouts of deflation, it’s not at American-type levels, but the latest CPI readings have been running a bit over 3%. For them, that almost feels like hyperinflation; regardless, it’s a lot higher than ½%. Consequently, Japan has deeply negative real yields. Pressure is now mounting on the BOJ to let rates rise, potentially a lot. In my view, the days of YCC in Japan are approaching their expiration date.

If that were to occur, the yen should rally hard. Based on its extraordinarily undervalued present status, the price surge could be jaw-dropping.

Not yet a paid Haymaker subscriber? Complete the brief survey linked below and we’ll set you up with a 90-day trial at no cost.

As it turned out, that was a half-good call. The Bank of Japan (BOJ) did indeed announce it was moving away from the yield curve control technique of artificially suppressing interest rates. That dramatic policy change did not, however, produce the “jaw-dropping” price surge I felt would also occur. In fact, as noted above, it has eased 4% and is very near its lowest level of the last decade, as you can see below. (Note that higher numbers on this chart mean that it takes more yen to buy one dollar — now almost 150 : 1; accordingly, up is actually down.)

Number of yen required to purchase one dollar (Since September 2013)

(Click chart to expand)