“Hard times create strong men, strong men create good times, good times create weak men, and weak men create hard times.” -G. Michael Hopf, from his novel, Those Who Remain

“So much anger, so much hate, yet unemployment so low; can you imagine the social disorder if unemployment hits 5%?” -BofA’s Michael Hartnett

The Great Disconnect, Part II

(Note: Due to the importance of this Haymaker’s subject matter, we have decided not to publish it behind the paywall.)

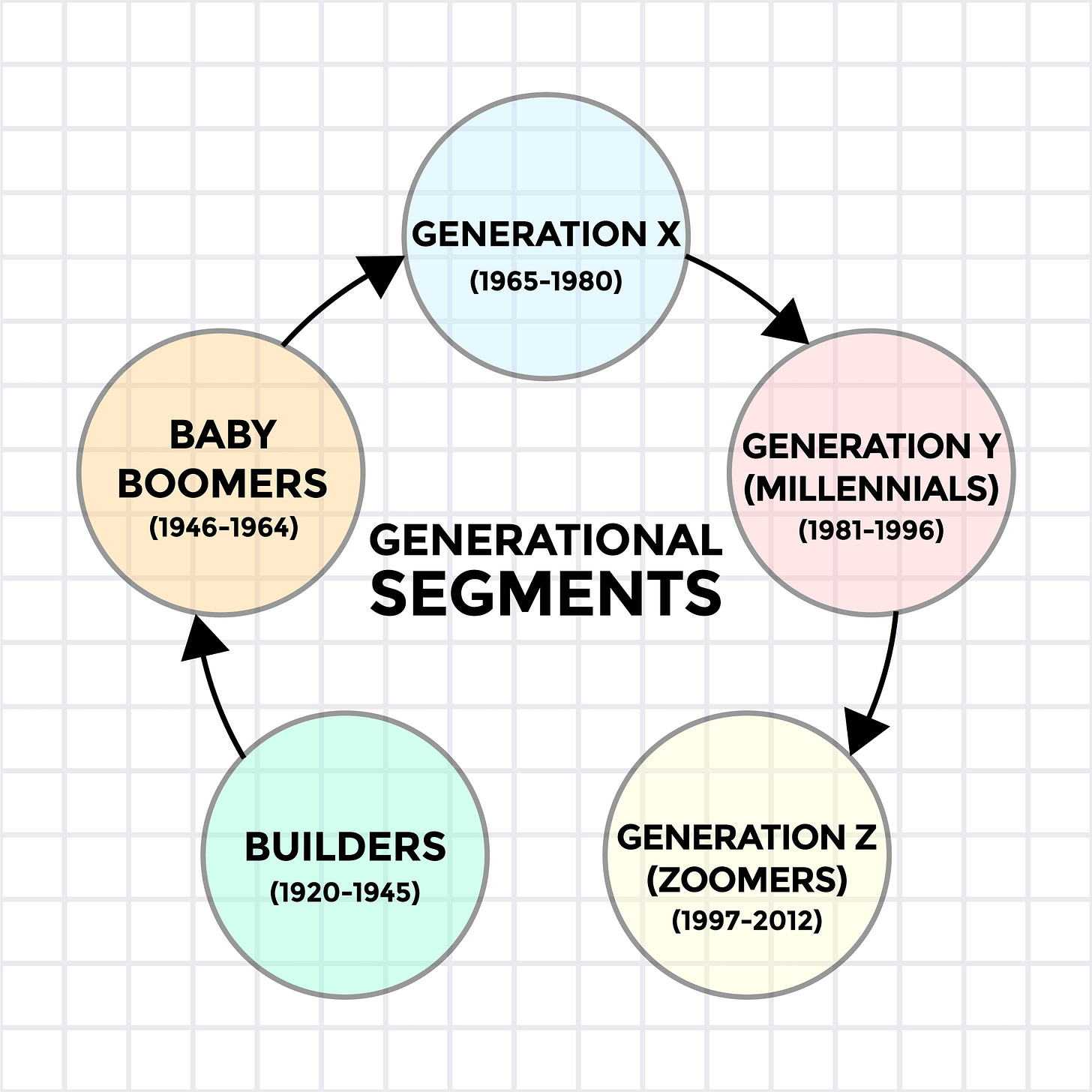

Much of this second installment of my series on The Great Disconnect will center on Neil Howe’s bestselling book, The Fourth Turning Is Here. Its basic premise is that there are four distinct seasons over roughly an 80-year period. Within that master cycle of history, which the ancient pre-Romans (the Etruscans) called a saecula, there are four “seasons”. Each of those 20-year periods is approximately equivalent to one human generation. (As you can see below, those seasons don’t precisely conform to the related generation.)

In some ways, it’s easier to grasp the concept by looking back from where we are now. Eighty years ago was the tail-end of the last Fourth Turning, or winter season, the conclusion of WWII. That ended the mega-crisis of the 20th Century which began with the Wall Street Crash of 1929 that led to the Great Depression. It was when the Greatest, or GI, Generation rose to the challenge. Those incredible young men and women ushered in the glorious spring that followed the apocalyptic winter which, globally, costs tens of millions their lives. Most of us have fathers or grandfathers who were part of this epic struggle against the Axis powers.

The Allies’ resounding triumph over fascism ushered in a period often referred to as the American High. In my case, I am just old enough to be able to recall the waning years of that euphoric period which ended around the mid-1960s. It was an exhilarating time of rapid economic growth, falling income inequality, and Pax Americana.

That’s not to say this era didn’t have its own difficulties. Anyone still alive who served in the “police action” known as the Korean War — like, for example, Clint Eastwood — certainly endured extreme sacrifice to keep the peace. (While the future Dirty Harry didn’t actually serve “over there”, he nearly lost his life in a training mission off the California coast.)

Yet, it was a relatively short and very localized conflict and the blood shed by those heroes, many of whom were also part of WWII’s GI Generation, created a nation that still endures. Its economic miracle stands in stark contrast to the crushing poverty still experienced in the northern half of the Korean Peninsula (another testimony to the “wonders” of Marxism).

Conversely, once the American High ended and another similar effort to contain communism was set in motion, the outcome was much different. Vietnam dominated the American political scene, and the national psyche, from the mid-60s into the mid-70s. It ended in a humiliating withdrawal that many considered to be America’s first military defeat. All of that country became a Marxist state. (However, to its partial credit, it has been a much more communist-lite version than North Korea.) It was still summer, but fall was coming.

The economy grew considerably in the 1970s but at the cost of high inflation. Yet, with Paul Volcker getting it back under control it did feel like summertime had returned in the 1980s. One could argue Volcker, along with Ronald Reagan, created an Indian Summer since autumn should have begun around the mid-1980s.

The economy stumbled somewhat under George H.W. Bush, but regained momentum with Bill Clinton in the White House. For a time, it seemed like the seasonal cycle had been broken. Then came 9/11, and seven years later, the implosion of the housing bubble. That, in turn, set off the Global Financial Crisis and the Great Recession. Winter had arrived and we are still in its throes.

Unsurprisingly, these mini-cycles don’t last exactly 20 years. Often, they are closer to 25 and sometimes shorter (like the last Fourth Turning which lasted from 1929 to 1945). Neil Howe feels this Fourth Turning, what the ancient stoics referred to as an Ekpyrosis phase or kataklysmos (from which the word “cataclysm” is derived) will be on the longer side. If he’s right, we’ve got almost another decade of rolling crises, likely of an escalating nature, with which to yet contend.

But I don’t have to tell you this unless, that is, the stock market’s present state of euphoria has blinded you to reality. Most of us realize that, to paraphrase Jim Morrison, hard times have found us. Popular media is picking up on this social phenomenon. As Neil Howe writes on page 3 of his book: “’How Dumb Can a Nation Get and Still Survive?’ asks one national newspaper headline. Yet another headline directs readers in a more instructive direction: ‘How to Tell When Your Country Is Past the Point of No Return’.”

At the bottom of that same page, he brings up a concern that has enormous investment and economic ramifications: “The public braces itself for the dark hour when the Fed can no longer ease and Congress can no longer borrow no matter how badly the economy founders.”

Due to the Fed’s fabrication of trillions of fake money — its various QEs — and the U.S. government’s totally out-of-control spending, America has “enjoyed” what I’ve repeatedly referred to as “pseudo-prosperity”. That was a big theme of the first installment of The Great Disconnect series. Therefore, I won’t rehash the dangers of what I’ve frequently called the “4-F scenario”, Federal Fiscal Funding Fiasco.

On the first point of the above quote, the Fed clearly would like to ease right now, but inflation is not cooperating. The federal government’s fiscal incontinence is a key reason for that. As my friend Adam Taggart has often said on his Thoughtful Money show, the Fed’s been hitting the monetary brakes at the same time that fiscal policy has been slamming the accelerator to the floorboards. There is a total absence of political will from either party, or the two leading presidential candidates, for that matter, to bring federal spending to heel. It is clear the U.S. Treasury will need to be dragged kicking and screaming into budgetary reform school.

Back in the 1990s, the Clinton administration’s spending plans were upended by the bond market. It’s fair to say those were drastically less extravagant than what’s happening in Washington, D.C., these days. At the time, the so-called “bond vigilantes” — i.e., debt market traders — would drive up Treasury yields when the red ink flowed freely (again, very modestly versus today). Their influence was so powerful that it caused senior Clinton advisor James Carville to moan: “I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody.”

Ominously for the federal government’s ability to continue to run $2 trillion annual deficits in order to create an illusion of prosperity, the bond vigilantes are riding again. As I write this on Wednesday, April 17th, bond yields are nearing 4.7%. That’s up almost a full percent (100 basis points) from where they were late last year. It’s also close to the 5% level they hit last fall that created severe market tremors. In my view, we’re getting close to the point where another rabbit-out-of-the-hat-trick by U.S. policymakers will be required. A leading contender for that would be allowing banks to buy U.S. Treasurys (USTs) with no reserve requirements.

The banking industry would undoubtedly love that and it would encourage them to pile into short-term USTs with even more gusto than they are currently. It might also trigger a rally in the long-end of the UST market, at least briefly. However, after the drubbing banks have already taken on their holdings of extended maturities, it’s doubtful they’d expose much of their precious capital to significant duration risk, as it is known.

Accordingly, there’s a clear threat of rates rising to uncomfortable levels on longer USTs, notwithstanding another feat of legerdemain on the part of U.S. policy mandarins. That could complete the double-whammy Neil Howe was warning about when he referred to the dark hour when neither the Fed nor the Treasury will be able to repeat the Covid-era multi-trillion-dollar tsunami of combined monetary and fiscal “stimmies”.

Frankly, it sends chills up my spine to contemplate an America facing the next recession with an inability to finance the support payments necessary to maintain social harmony. Even John Maynard Keynes, the father of Keynesian economics, would never have endorsed the idea of running $2 trillion deficits during an expansion and with near record-low unemployment. His model was built around running surpluses and paying down debt during good times. This provides a government with the ability to stimulate during a severe downturn. Clearly, the current U.S. ruling class didn’t get the memo… or the textbook.

The question of how angry and violent America will get when “the dark hour” arrives is what terrifies me. Apparently, I’m not alone. Perhaps you have read reviews of the new movie Civil War. I have and they make my flesh crawl. The worst part is that the premise — America at war with itself — now seems plausible, whereas prior to the pandemic and the events of January 6th, 2021, they would have seemed outlandish. In its review of this film, Bloomberg Businessweek wrote: “The effect is horrifying, and it makes for one of the most frightening moviegoing experiences in recent memory.” The New York Times opined that, “… (it) is not a dangerous provocation. It is a necessary warning.” As I wrote in this series’ first installment, half of all Americans think a civil war will happen in the next few years.

Neil Howe covers this on page 262 of The Fourth Turning Is Here, quoting Barbara F. Walter, who is an expert on civil wars, in countries such as Rwanda and Myanmar. He writes:

When asked about America, she say the evidence is pretty clear: ‘We are a factionalized anocracy* that is quickly approaching the open insurgency stage, which means we are closer to civil war than any of us would like to believe.’

*Per Wikipedia (yes, I needed to look that up), this is a regime that mixes democratic with autocratic features.

Personally, that’s the last thing I want to remotely consider, much less believe, but the current societal trends are beyond disturbing. The fear that sears my soul is that the upcoming presidential election may take this to a violently divisive level. That’s why I did my best to aid No Labels in its efforts to put forth a unifying candidate. Clearly, neither Joe Biden nor Donald Trump have displayed a scintilla of an ability to heal our wounds, mostly self-inflicted, and bring us together.

One of the overarching themes of The Fourth Turning Is Here is that we are, indeed, heading to a war-like crescendo of some kind. It could be due to internal conflicts or those of an external nature, or both. If so, it would be the fourth, coincidentally, in U.S. history. The Revolutionary War, the Civil War, and WWII were the first three. Intriguingly, they have been about 80 years apart, the aforementioned four-generation timespan, or saecula.

Another coincidence is that on Monday, as I was starting this installment of The Great Disconnect, I listened to my good friend Adam Taggart interview Darius Dale. In prior Haymakers, I have given positive shout-outs to Darius both in terms of his lucidity and his remarkable command of economic data. As some of our readers have pointed out, his 42 Macro process has achieved excellent investment results, as well.

What struck me this time was his own confrontation with the dramatic divergence between heavily caffeinated current conditions and the rising specter of The Fourth Turning. The former has caused him to be correctly bullish on a short-term basis while the latter has him seriously contemplating how to protect his clients from the potential ravages of America’s latest mega-crisis. (He also correctly notes that Fourth Turnings drive inflation to roughly double pre-crisis levels, an effect we’ve already experienced… and continue to experience. We’ve included a link to the Taggart/Dale conversation at the end of this Haymaker.)

As it turns out, Darius is close friends with Neil Howe and, unsurprisingly, holds him in very high regard. He is, like me, convinced we are in the middle innings of the Fourth Turning (in my case, I’d say middle to late). Per Neil Howe, it began during 2008’s Global Financial Crisis. He speculates it will end somewhere around 2030 to 2033.

If so, the good news is that we are most of the way through this cathartic — and regenerative — process. The bad news, possibly, is that the worst is yet to come. But, in my view, it is dangerous to assume that the ultimate resolution is still years away. That may not be the case at all. In the last Fourth Turning, WWII started well before that crisis era ended, one that broke very much in the USA’s favor.

It could happen again. Despite all the dire threats, I remain optimistic on America’s ability to adapt and regenerate. In fact, I don’t think any country rivals us in that regard. As Darwin is apocryphally quoted as having written (on the eve of America’s Civil War, by the way): “… in the struggle for survival, the fittest win out at the expense of their rivals because they succeed in adapting themselves best to their environment.”* (As a side note, it surprises me how much push-back I receive when I opine that we can come out of our fourth Fourth Turning a stronger and less economically stratified nation.)

*That specific wording, according to Quote Investigator, “… was located within a history textbook titled ‘Civilization Past and Present’ by T. Walter Wallbank, Alastair M. Taylor and Nels M. Bailkey.”

In an upcoming installment of The Great Disconnect, I will outline a number of measures we can implement to get us through our latest Fourth Turning. America continues to possess some of the greatest advantages and assets the world has ever seen. As some of you may recall, I’ve written on those previously. But, for now, one of my greatest fears is the shocking lack of intelligent and patriotic political leadership. Unfortunately, I do believe it will take a crisis of massive proportions to bring forth those with the courage to lead us out of the engulfing darkness and back to that shining city on the hill that once was America.

IMPORTANT DISCLOSURES

This material has been distributed solely for informational and educational purposes only and is not a solicitation or an offer to buy any security or to participate in any trading strategy. All material presented is compiled from sources believed to be reliable, but accuracy, adequacy, or completeness cannot be guaranteed, and David Hay makes no representation as to its accuracy, adequacy, or completeness.

The information herein is based on David Hay’s beliefs, as well as certain assumptions regarding future events based on information available to David Hay on a formal and informal basis as of the date of this publication. The material may include projections or other forward-looking statements regarding future events, targets or expectations. Past performance is no guarantee of future results. There is no guarantee that any opinions, forecasts, projections, risk assumptions, or commentary discussed herein will be realized or that an investment strategy will be successful. Actual experience may not reflect all of these opinions, forecasts, projections, risk assumptions, or commentary.

David Hay shall have no responsibility for: (i) determining that any opinion, forecast, projection, risk assumption, or commentary discussed herein is suitable for any particular reader; (ii) monitoring whether any opinion, forecast, projection, risk assumption, or commentary discussed herein continues to be suitable for any reader; or (iii) tailoring any opinion, forecast, projection, risk assumption, or commentary discussed herein to any particular reader’s investment objectives, guidelines, or restrictions. Receipt of this material does not, by itself, imply that David Hay has an advisory agreement, oral or otherwise, with any reader.

David Hay serves on the Investment Committee in his capacity as Co-Chief Investment Officer of Evergreen Gavekal (“Evergreen”), registered with the Securities and Exchange Commission as an investment adviser under the Investment Advisers Act of 1940. The registration of Evergreen in no way implies a certain level of skill or expertise or that the SEC has endorsed the firm or David Hay. Investment decisions for Evergreen clients are made by the Evergreen Investment Committee. Please note that while David Hay co-manages the investment program on behalf of Evergreen clients, this publication is not affiliated with Evergreen and do not necessarily reflect the views of the Investment Committee. The information herein reflects the personal views of David Hay as a seasoned investor in the financial markets and any recommendations noted may be materially different than the investment strategies that Evergreen manages on behalf of, or recommends to, its clients.

Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this material, will be profitable, equal any corresponding indicated performance level(s), or be suitable for your portfolio. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Investors should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

David. We created our own Anocracy* by ignoring our Founding Father's wisdom. They knew that every democracy in history ended in autocratic rule. (Every. Democracy.) ... Typically after popularly electing a demagogue who then "reluctantly" agrees to be King.

The Fathers knew about Aristotle's forms of governments: Rule of One (kings or tyrants), of Few (aristocrats or oligarchs), or Many (polity or democracy). Spoiler: to Aristotle, to Washington, to Adams, and especially to Tom Jefferson - Democracy was the B.A.D. form of government they wished to avoid. They had hoped to balance the powers between the States, the President (the One, or Roman Consul), the Senate / Courts (aristocrats of the States, or Roman Senate), and the House (the polity or Roman Tribunes). Sadly, the Civil War and the 17th amendment removed power from the States and turned the Senate into an echo chamber of the House.

Voila! Anocracy.

Just like the Ancients, we now have Alcibiades instead of Solon and Pericles; we have Caesar and Sulla instead of Cincinnatus and Cato. This outcome wouldn't surprise Russell Kirk, any student of the Roman Republic, or any student of the French Revolution...

I strongly suggest you read two books: Kirk's <Roots of American Order>, and Duncan's <The Storm Before the Storm> for more context. Godspeed.

*a regime that mixes democratic with autocratic features.

Seriously thought provoking. Thank you!