“Never [Occasionally] The Twain Shall Meet”

“All that glitters certainly isn’t the gold mining sector.” -A frustrated investor in precious metals stocks.

Mark Twain famously quipped that a gold mine is a hole in the ground with a liar standing at the top. The last 150 years or so have proven the wisdom of his appraisal in far too many cases. Notwithstanding that, there have been some solid companies built in this extremely high-risk industry. Those tend to populate the ETF that trades with the ticker symbol GDX.

Here comes a big “however”: as I’ve written before, the operating performance of most blue-chip diversified oil and gas producers has been far superior to that of even the top-tier gold miners. That’s a key reason I’ve been much more interested in energy companies when they’ve been on sale. (Per this week’s Making Hay Monday, the great irony, presently, is how much more depressed many renewable energy stocks are than the “dirty” versions. In my view, there are some opportunities among the green variety, though this week’s whopper rally in those argues for a better entry point.

Despite that qualifier, I believe there is presently a quadruple-whammy — perhaps, twin twains (or actually a quintuple whammy) — at work right now that is creating another chance to capitalize on what might be the most vigorous rally by the gold miners since 2020. The stars are aligning enough for this long-maligned sector, I might even be able to convince Mark Twain himself that they’re poised to surge… if the rumors of his demise were not greatly exaggerated.

Frankly, trading the high volatility of this sector has been the only way to make money on miners for over a decade. For those willing to play the swings, there have been some phenomenal ascents… followed by sickening collapses. Interestingly, the most exhilarating rallies have happened with a set of conditions that are converging once again.

The first parameter that has been met is a sharp decline from a given year’s high. That happened in 2013, 2015, 2016, and 2022. As with most poor-performing sectors, that usually leads to tax-loss selling pressure toward year-end, pushing them down even further. It also creates a coiled-spring effect once the tax-driven liquidation ends. From the early-December low to the peak the following year, the worst return was 25%. (December 2018 was also followed by a strong snapback in 2019, but GDX actually didn’t fall much during 2018, so I left it out.) Despite a 5% leap on Tuesday, GDX remains down 20% from its apex earlier this year. Therefore, tax-loss selling pressure is likely weighing on it at this point.

The potential for a year-end bounce back is nice, but there’s much more at work this time around. One intriguing development is how much GDX has lagged the price of gold this year. As you can see below, this gap is totally unprecedented even during this terrible 12-year stretch for the miners.

The yellow metal itself hasn’t been exactly a star from its 2011 high, either. This is particularly the case when considering inflation. That’s enough to cause even a committed goldbug (whose family probably thinks he or she should be committed to some kind of institution by now) to lose faith.

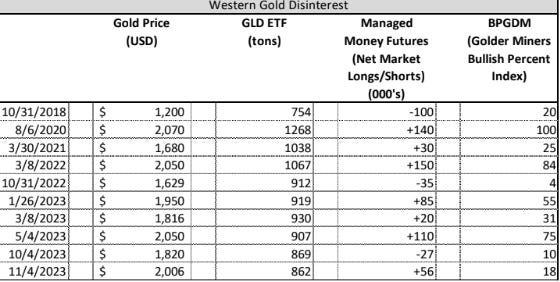

Why this stunning dichotomy? There could be several causes, but I’d posit one that is the most plausible is captured in these visuals from the prolific Luke Gromen.

Central banks are clearly demonstrating a preference for bullion as their reserve instrument of choice. This is increasingly in lieu of holding U.S. Treasurys, which the federal government has been creating at a multi-trillion pace — two trillion in 2023 alone — in recent years. Conversely, Western investors have been exiting funds that hold physical gold (hopefully).

In addition to the shedding of 200 tons of gold by the GLD ETF, the next largest version, the iShares Gold Trust (IAU) has also experienced outflows of 23.5% of its assets since the start of 2021. (Thanks to one of the planet’s most successful gold investors and commentators, Fred Hickey, for those stats and the above table.)

Obviously, central banks don’t buy gold mining stocks. Accordingly, GDX’s constituents have not had the international buying support to offset domestic investor abandonment, unlike with bullion itself.

Another encouraging piece that has also fallen into place lately is the Gold Miners Bullish Percent Index (BPGDM). Also shown in Fred’s table above is BPGDM’s current reading. At 18, it’s one of the lowest ever. Contrast that to a reading of 100 in August of 2020 as the miners were topping out after a spectacular run.

Note also that gold rose from $1200/ounce off of a depressed BPGDM reading of 20 in October 2018 to $2000 by August 2020, or a 67% increase. Further notice that when this index hit the rock-bottom 4 level in October 2022, it roared back by over $300/ounce in just two months. Fred also provided the following image to underscore how low are the recent readings, in October and this month, based on the last five years. (By the way, I believe all serious gold investors — all four of you! — should subscribe to his monthly letter; the annual subscription is just $150.)

Fred also noted in his October newsletter that the Daily Sentiment Indicator he tracks is strongly indicating a rally is nigh. Per Fred in that edition: “All the other indicators I follow including CEF* discounts…open interest in futures contracts (very low) and others are at levels seen at precious metal bottoms.” Giving him a well-deserved shout-out, gold is up 7% from when he wrote those words.

But the focus of this Haymaker is more on the miners than gold itself. And here’s where there is a fascinating factoid of which I doubt most of you are aware. Even though Tuesday’s monster market rally front-ran my tout of the gold miner ETF, with its S&P-beating 5% pop, it did highlight how excited investors get when they come to believe the Fed has finished raising rates. But here’s the problem with that euphoric reaction: unless a soft-landing is achieved, this is actually bad news for most stocks.

Why is that?