Charts of the Week

1. The last three years have been glorious for traditional energy stocks. When it comes to those that qualify for the alternative designation, it’s been the polar opposite. Considering the hundreds of billions showered on this group by the counterintuitively named Inflation Reduction Act, that’s quite surprising. The reversal has been so powerful that Green Energy stocks have now lagged their conventional rivals going all the way back to 2014.

Considering that the shares of “old energy” companies have materially lagged the S&P since then, that factoid is downright startling. Should the U.S. government’s money spigot — the Treasury market — get at least partially turned off by the “bond vigilantes”, the future looks even cloudier for solar and wind stocks. Electric Vehicles (EVs) have also been experiencing less than stellar demand of late, alarming a number of Western automakers. A probable diminution of generous federal subsidies is another headwind for EVs, especially when the government’s borrowing costs are going vertical.

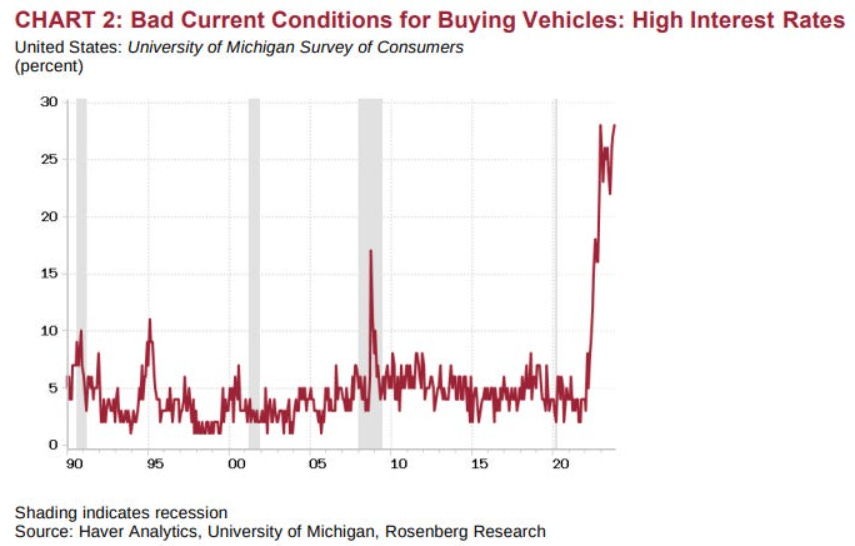

2. According to government statisticians, the U.S. economy is accelerating. Yet, in addition to cautious commentary from a plethora of senior corporate executives, there is also the reality that the outlook for both home and new car sales is, to put it bluntly, terrible. The fact that these two industries have such a major impact on the economy — particularly, based on the number of contractors and suppliers that depend on them — calls into question the sustainability of the economy’s growth path.

“By our estimates, the gap in expected returns between equities and bonds has joined the worst levels in history, matched only by extremes in mid-1929 and early-2000.” -The Hussman Funds’ John Hussman

“There has never occurred a hyperinflation in history which was not caused by a huge budget deficit of the state… In all cases of hyperinflation, deficits amounting to more than 20 per cent of public expenditures are present. We’ve exceeded that level in each of the past five years – even in 2019, before the pandemic.” -Economist Peter Bernholz, as quoted by Luke Gromen

Collateral Damage

One of the primary casualties of the global bond market collapse has been emerging market debt, particularly the U.S.-based closed-end funds that hold these securities. This has particularly been the case with bonds denominated in local currencies, i.e., those not issued in U.S. dollars.

In reality, the thrashing of two of the more prominent closed-end funds (CEFs) has been occurring for more than 10 years. The charts of those, the Morgan Stanley Emerging Markets Domestic Debt Fund (EDD) and the Templeton Emerging Markets Income Fund could turn the stomach of even a veteran oceangoing sailor.