Friday Haymaker

What's a "Reverse Trichet"?

“When Europeans and Asians worry about the future they save money; when Americans worry about the future they spend money.” -BofA Investment Strategist Michael Hartnett

So, what is a “Reverse Trichet”, as Haymaker friend and StoneX Director of Global Macro Strategy, Vincent Deluard, puts it?

The “Trichet” in question is actually one Jean-Claude Trichet, a prominent financial figure of some Trans-Atlantic infamy. His role as European Central Bank President coincided with what we in the Haymaker camp have long termed Bubble 2.0, also known as the Global Financial Crisis. In his piece below, Vincent lays out the case for why Trichet’s rate-hiking tendencies of 16 years ago were bad policy. Considering that he raised rates into the most epic economic implosion of the post-WWII era is prima facie evidence of his grand whiff. Jay Powell, though, might be poised to make the opposite mistake — easing into persistent inflation and an economy that refuses to cry “Uncle!”. (Unquestionably, it must be admitted, with inordinate amounts of largesse from Uncle Sam).

What might surprise you is that, in this instance, Team Haymaker is not necessarily in agreement with Vincent, who reliably lays out strong cases and whose views are always worth considering. It’s not to say we don’t vehemently agree with his premise that, in the world of macroeconomic policy “political moves rarely work”. Rather, Jay Powell’s motivation for starting the next rate cutting cycle might be legitimate concerns about the long-anticipated recession belatedly make a command performance.

Clearly, Vincent sees this very differently, though he does concede that a considerable amount of actual economic data (versus surveys) have recently turned in a decidedly southerly direction lately. On the other hand, he sees income tax receipts as particularly encouraging, as you will read. We fully agree that most entities, be they corporate or individual, don’t pay taxes on non-existent income (unless, in the former case, their stock option packages are close to vesting!).

It's precisely because Vincent makes such a cogent and persuasive case against our current leanings that we wanted our readers to see his commentary. As many of you know, we’ve vacillated over the last couple of years between thinking a recession was a virtual lock and reluctantly conceding it would be delayed (though not avoided). My shifting stance was primarily due to unprecedented levels, at least during a non-crisis, of deficit spending.

When you read as much conflicting economic research as we do, it’s hard not to be pulled in opposing directions. It’s enough to recall the days when the buck-stops-here president — as opposed to today’s the buck-stops-anywhere-but-here poor excuse for prevailing executive leadership — was faced with the usual equivocating by his economic advisers. This caused Harry Truman to blurt out: “Will someone please find me a one-handed economist?!!”

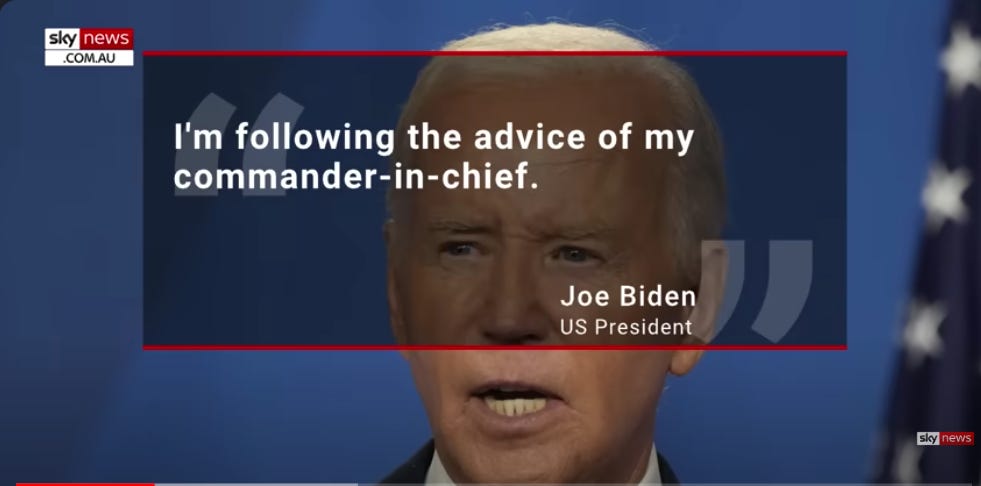

For those, like Team Haymaker, who are trying our best to make sense out of the steady stream of confusing and countervailing economic data rushing around these days, we can only summon up the wise words of our current Commander-in-Chief* and firmly mumble, “Well, anyway…”

*After introducing Ukrainian president Volodymyr Zelenskyy as Vladimir Putin and declaring Donald Trump as his chosen VP running mate, Biden indicated that the current Commander-in-Chief is someone other himself. Per Sky News, at least one Twitter/X user suggested that person could be Barack Obama. Hey, the way things are going for the POTUS these days, it’s not a bad idea to have a fall guy.

Bonus visual:

We saw this in Kevin Muir’s (The MacroTourist’s) recent Substack post and thought those of you who aren’t already subscribed to Kevin’s newsletter might appreciate our re-posting it here. Thanks, Kevin!

Summer Fog, with Risks of a Reverse Trichet

Vincent Deluard

Recent macro data has been weak and cyclical trades have underperformed lately

Tax collections are very strong, the labor market is still tight, and summer spending is off to a great start

The Fed wants to cut to stay consistent with its forward guidance: September is the best meeting to do so

Trichet also took macro gambles in 2008 and 2011 to stay consistent with his word: political moves rarely work

There’s a wonderful phrase: ‘the fog of war.’ What “the fog of war” means is: war is so complex it’s beyond the ability of the human mind to comprehend all the variables. Our judgment, our understanding, are not adequate. And we kill people unnecessarily. – Robert Mc Namara, reflecting on the Vietnam war

As teams progress to the knock-off stage of the Euro 2024, draws will be decided by penalty shoot outs. A 2007 paper found that “given the probability distribution of kick direction, the optimal strategy for goalkeepers is to stay in the middle of the goal. Goalkeepers, however, almost always jump right or left.”

Goalkeepers prefer to be seen as “doing something” and avoid the embarrassment of just standing there.