Fed Up With The Fed

In The Ring - May 27th, 2022

“A dozen years of interest-rate suppression have misdirected capital, misinformed investors and fostered commercial and speculative structures… unwilling to accept the inevitable collateral damage, the Fed will cut short its anti-inflation campaign… we say it will return to inflationary business as usual.”

- Jim Grant (May 13, 2022)

Let me acknowledge up front that I owe credit for 2/5 of the above title to my fellow newsletter scribe and kindred critic of America’s central bank, Danielle DiMartino Booth. Her book, Fed Up, was the inspiration for this Haymaker edition, one that will refer to a book I published via Substack earlier this year.

The Fed is also the “star” — actually, more like antihero — of my project, Bubble 3.0 (Thanks immensely, by the way, for all of you who have read it and, especially, those who have taken the time to send me your encouraging comments).

Danielle was a senior official at the Dallas Federal Reserve Bank in the lead-up to the Global Financial Crisis which was primarily caused by the housing bubble of the 2002-2007 era. She had a ringside seat (and the Haymaker has a special affinity for those!) to the cavalier attitude the national Fed displayed to what were obviously wildly imprudent mortgage lending practices.

Danielle attempted to warn her superiors of what she strongly believed to be an utter disaster in the making. Sadly for the country, she was ignored. Alan Greenspan even went so far as to encourage homeowners to take out adjustable-rate mortgages (ARMs) at the same time the Fed was dramatically, though slowly, increasing interest rates. Though back then I didn’t know, or know of, Danielle, I was on a similar mission to caution every client and newsletter subscriber I could that the home loan market had taken leave of its senses.

Longtime readers are aware that I believed there was a clear connection between the dot.com and the housing bubbles (what I refer to as Bubbles 1.0 and 2.0) respectively. In the wake of the tech wreck, the Fed cut its key overnight rate all the way down to a Great Depression-like level of 1% and left it there even as housing prices began to soar in 2003 and 2004. Finally, in June of the latter year, it began its tightening process that would run for two years.

By June of 2006, it had hiked the fed funds rate by over 4%, raising it almost every month by ¼%, to 5.25%. Yet, it moved so languidly and predictably that markets continued to overheat, particularly housing. But by the summer of 2007, that 5.25% rate, well above the CPI, which was running at about 3% clip that year, began to bite. Subprime mortgage hedge funds started imploding. But the real disaster would come the following summer.

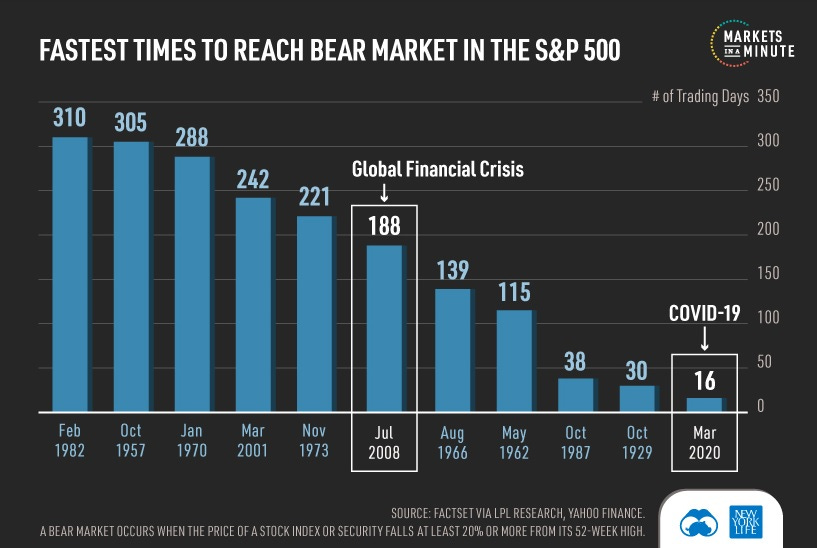

Right after Labor Day, 2008, systemically important financial firms such as Lehman Brothers, AIG, and Washington Mutual, were collapsing under the weight of impaired mortgage loan portfolios. (AIG was brought into government conservatorship by its massive portfolio of credit default swaps it had sold on collateralized debt obligations comprised of subprime mortgages.) The Global Financial Crisis was entering its nightmare phase.

Source: Visual Capitalist

The intensity of the panic that accompanied it caused the Fed to cut interest rates to near zero. It also began a temporary — or, I should say, transitory — emergency program that became known as Quantitative Easing, or QE. Then-Fed chairman Ben Bernanke assured Congress during the financial crisis that QE would have a short shelf-life. Yet, in September 2019, over 10 years later, the Fed was back doing its unofficial fourth round of QE.

The decade following the financial crisis was characterized by near-zero interest rates and continual money fabrication via QEs 1, 2, 3, and, de facto, 4 (the September 2019 repo market intervention of $90 billion per month that continued right up to Covid). This caused almost every U.S. asset class to drastically inflate in value.

The consensus view post-2009 was that housing prices would never again rise to the levels seen in 2007. The same belief held with commercial real estate – then came the pandemic.

Another QE was deemed inadequate to deal with the overnight shutdown of most of the global economy. QE was a monetary solution but policymakers believed Covid necessitated a fiscal response, as well. In plain English, this meant programs like the PPP and stimulus checks. Early on, these were certainly necessary, even essential. What ensued was not.

By the summer of 2020, it was becoming obvious to impartial observers, such as Wharton’s venerable Jeremy Siegel, that massive overstimulation, both by the Fed and the federal government, was occurring. The money supply had increased by 40% almost overnight, an unprecedented development. Stimulus payments were so generous that businesses were reporting difficulties finding people willing to work. The quantity of money relative to the supply of available goods and labor began to get out of whack. A global supply chain in utter disarray unquestionably poured napalm on the fire.

By early 2021, there was growing evidence of a brewing inflation problem, as Prof. Siegel had presciently warned six months earlier. Moreover, a speculative craze was unfolding in the financial markets that exceeded anything seen in U.S. history. It even surpassed the late ‘90s tech bubble that started the chain reaction of repeated Fed easings. These ultimately produced what I and others have called the “peak insanity” phase in early 2021. The maniacal action in asset classes, using the term very charitably, such as cryptocurrencies, SPACs, IPOs, NFTs and meme stocks made the late ‘90s dot.com speculative orgy in speculation look almost puritanical.

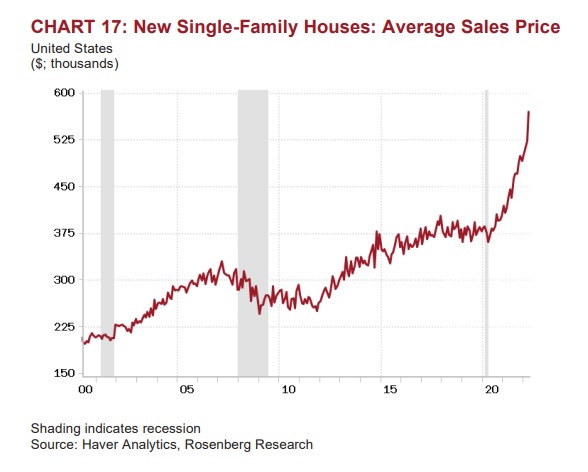

Real estate prices exceeded even the dizzying heights of 2006. Home prices are now 10% above the supposedly unsurpassable peak of 2006, and that’s net of inflation. Multiple offers and nearly instantaneous sales were once again the norm in many housing markets in 2021 and into 2022, as well. Commercial real estate, gravely wounded by Covid, also roared back, at least in terms of selling prices (fundamentals were often not nearly as robust).

Chart: Rosenberg Research

Yet, incredibly and inexplicably, the Fed was in complete denial mode. Jay Powell’s commentary during last year’s peak insanity was particularly infuriating, as I recounted in Bubble 3.0 . Its subtitle is: “Who Blew It and How to Protect Yourself When it Blows Apart”. As I’m sure all readers are well aware, there is no doubt in my mind about who blew it — from both an inflation and policy mistake standpoint.

This excerpt from Bubble 3.0 gives you a strong sense of how bubble-blind Jay Powell was in the first half of last year (his words are italicized):

“The Fed has repeatedly batted away concerns that the stock market is in another bubble by pointing out that the earnings yield is much higher than the interest rate on long-term treasuries. Here’s a typical response to a reporter’s question about overheated market conditions from… Jay Powell, as the mania in meme stocks was raging in early February of 2021: ‘If you look at P/Es, they’re historically high, but, you know, in a world where the—where the risk-free rate is sustain—is going to be low for a sustained period, the equity premium, which is really the reward you get for taking equity risk, would be what you’d look at. And that’s not at, at incredibly low levels, which would mean they’re not overpriced in that sense.’

Wait, it gets worse. Later in the same press conference, Mr. Powell threw out this line: ‘So if you look at what’s really been driving asset prices really in the last couple of months, it isn’t monetary policies. It’s been expectations about vaccines.’ His last point is a fair one, except that he uttered these words during the… meme-stock insanity that saw GameStop, AMC Entertainment, and BlackBerry ripping 2,385%, 842% and 326%, respectively in a few weeks. This was in addition to a litany of other lottery-ticket stocks that experienced moonshot trajectories. To believe that type of hyper-speculative behavior was a result of vaccines, rather than trillions of free money sloshing through markets, is either extremely naïve or exceedingly disingenuous.

But here’s the real clincher — a few sentences later he had the chutzpah to say: ‘And I think, you know, I think that the connection between low interest rates and asset values is probably something that’s not as tight as people think, because a lot of different factors are driving asset prices at any given time.’

Really? Just a few minutes earlier, Jay, you dismissed fears that this is one of the biggest equity bubbles of all-time, which this author absolutely believes to be the case, by saying prices are justified by low rates (that you created). And then you say it’s not as tight a connection as people think? Oy vey, this is some serious double-talk, even for a politician, which the head of the Fed has clearly become.”

A similarly irresponsible attitude was evident toward not only asset price inflation but that of a consumer price variety, as well. Again, quoting from Bubble 3.0:

“As recently as the summer of 2020, at the Fed’s annual shaker and mover convocation in Jackson Hole, Wyoming, Mr. Powell was begging for higher inflation. Here’s what he had to say:

‘Many find it counterintuitive that the Fed would want to push up inflation. After all, low and stable inflation is essential for a well-functioning economy. And we are certainly mindful that higher prices for essential items, such as food, gasoline, and shelter, add to the burdens faced by many families, especially those struggling with lost jobs and incomes.’

Yet, through most of 2021, the Fed assured the world that the string of shockingly high inflation prints that became evident in the first part of last year were the now-infamous ‘transitory’. If this was just an uncharacteristic bad call, that would be excusable. The reality… is that it is standard operating procedure for the Fed. Putting aside its…inability to forewarn of a single recession, and the monstrous miscalculation it made with regard to the housing market in the early 2000s, it consistently overestimated economic growth through the last decade. It also mis-predicted inflation — back then, on the downside. Again, to me, that was a happy event, but the Fed disagreed… and they’re the ones with the printing press!

Courtesy of data-sleuth extraordinaire David Rosenberg, one of North America’s preeminent economists, over the last decade, which includes 110 major economic datapoints, here’s how ‘well’ the Fed has done in the forecasting department:

On its own fed funds rate, it has been correct 37% of the time.

With what it calls core inflation, 29% of the time.

On the unemployment rate, 24% of the time.

Regarding real GDP, 17% of the time.

Clearly, the Fed needs to spend some of its enormous budget on a dartboard. Based on the fact that the Fed sets the fed funds rate (hence the name) that one strikes me as particularly pathetic.”

It’s no longer a matter of predicting the demise of Bubble 3.0, it’s merely observing its obvious deflation occurring on a regular basis, notwithstanding the usual bear market rallies. Per earlier newsletters this year, the carnage in what I have long called the COPS (Crazy Over-Priced Stocks) has been stunning. Many are down 70% or more. The bloodletting in areas like the most speculative cryptos—and there are literally thousands of those, involving hundreds of billions, at least prior to their slaughter—has been akin to a Civil War surgical tent. Even many high-quality companies, that weren’t all that overvalued, have seen their share prices cut in half.

Because the Fed sets the pace, most other central banks are also now in clamp-down mode. The global loss of stock and bond market value was recently estimated by Société Générale at $27 trillion. However, the aggregate market capitalization remains about $17 trillion above trend. In other words, there could be a lot more pain to come. This is especially true now that Jay Powell has decided to channel Paul Volcker.

Paul Volcker - Source: Wikimedia Commons

He was warned repeatedly — even, incredibly, by members of Congress — that he was playing with fire by injecting trillions of liquidity into markets that were hyperventilating and an economy that was basically sold out of labor and goods. But he plowed ahead all of last year and into this year, as well. It’s astounding to realize the Fed was still fabricating money as recently as March.

He was cautioned that if he kept the accelerator pinned to the floorboards, he wouldn’t be able to merely tap the brakes. Rather, he’d need to slam the brakes and activate the airbags. Financial markets were likely to be the first casualty and they’re already crash-test dummies.

The problem is that Mr. Powell continues to be, to use a highly technical term, ginormously behind the inflation curve. He needs to tighten at a rate that hasn’t been seen since the days of his new-found hero, the abovementioned Paul Volcker (who, by the way, would never have allowed the situation to get this out of control).

Consequently, he’s vowing to prove me wrong (per my scenario analysis quoted above) and ignore further market mayhem. His tough talk and that of his formerly ultra-dovish Fed colleagues implies they will keep tightening no matter how far stocks fall. And I believe them… to a point. But somewhere around down 35% on the S&P I’m convinced they will lose their fortitude. The blowback to the real economy, and Federal government tax revenues, will become a political issue, which is fitting – the Fed has very much evolved into a political institution.

Putting aside what I think will happen, it is a tragedy and a travesty that the Fed basically forced millions of Americans, including of the older generations, into stocks and other high-risk assets by extinguishing returns on safe investments. This was its stated objective, one it pursued almost non-stop since 2009. Now it is going to nuke their stock portfolios — and their bonds aren’t doing much better — after having pumped them up to dangerously high levels. As the old saying goes, this is no way to run a railroad. Swap out “railroad” for “the world’s most important central bank” and the saying updates rather well.

An Ask Of Our Subscribers

Haymaker has a lot of rounds ahead in what would be a very tough fight without you in our corner. You can back us up by tapping the heart and, even better (though we appreciate both), weighing in with a comment. If you haven’t done so, look for the intuitive shapes, and keep your favorite financial pugilist punching with all his might.

Okay, that’s the bell. We’re back at it.

While I'm in agreement with pretty much all that's been stated here, I haven't seen a final massive blow-off top that usually occurs when Markets get out of hand. Colour me silly, I know, but We humans are prone to making the same mistakes over and over again ala General George Santiana. The Fed HAS lost the plot because it's mandate had drifted into silliness such as fighting "Climate Change"(TM) and controlling employment levels, etc. I ask "How on Earth is a Central Bank suppose to control Employment or "fight" Climate Change(TM)?" The better question is Why? Sad that totally uninformed Wokesters have hijacked pretty much all levels of Authority...

Agree 100% about Fed track record. Back in 2005 tried to discuss the housing bubble with then Fed Chief Economist and he refused to put any of his hundreds of economists to evaluate the problem because Greenspan had already said there was a little froth in the market. Plus he wanted to see a model with good regression characteristics even though the situation was without historic precedent, so models were of no value. Current situation is not much better.