A Message From The Haymaker

As I’ve previously conveyed, Mark Joseph Mongilutz has played a major role in my creative endeavors for years. Besides his invaluable assistance in the creation and publication of my two books, he’s an author himself. Among other endeavors, his book Solemn Duty In The Old Guard recounts his service with the 3rd United States Infantry Regiment, which included participation in the immediate aftermath of 9/11, when his company went into the still smoldering Pentagon the day after it was attacked. Mark also served in both Afghanistan and the Horn of Africa.

Additionally, Mark’s understanding of history than anyone I know other than my long-time partner, Louis Gave. A little over a month ago, Louis, Mark and I co-authored a Haymaker titled Send in the Drones, and in today’s edition Louis was kind enough to contribute a couple of pertinent thoughts to Mark’s piece, which you’ll find below.

Coincidentally, Louis is doing a podcast on June 7th on a highly related topic, Wars and Their Consequences, at 12 pm PDT. In this presentation hosted by Charles Schwab, Louis will be discussing how war has changed in the modern era and its impacts on the financial market. Click the image below to register* for this online presentation.

*Online registration requires office branch selection.

Louis is one of the world’s foremost financial figures and was recently featured in a Barron’s article which happened to be that edition’s centerfold. He took my joke that he was no Burt Reynolds with his usual good humor. Frankly, I can’t believe how fortunate I am to have worked closely with him for years and not only call him partner but my great friend.

Before moving onto Mark’s article on the often-muddled reasons nations go to war, I did want to point out to all Making Hay Monday readers that Evergreen has sold its clients’ position in Panasonic. As some of you know, this was a “pick to click” in our Tracked Equity Portfolio. Before you take any action, however, I do want to advise you that we executed this transaction as part of a tax swap into another Japanese company.

Personally, I continue to hold Panasonic in my “long-short” portfolio and there’s a high probability Evergreen will buy it back once the requisite 31-day waiting period has expired. As I did point out when I first recommended Panasonic, a safer and much more diversified way to gain exposure to the Japanese market, which I continue to believe is deeply undervalued on a long-term basis, is EWJ. This is the iShares MSCI Japan ETF.

Now, on to the main article…

Bananas, Semiconductors & Multi-Message War-Hawking

Any casual reader of military history will inevitably recognize that warfare’s motives are rarely singular. An international conflict’s origins are as likely to be rooted in decades’ old transgressions (perceived or actual) as they are in recent tensions; wars, as we often learn too late, are almost always marketed through simple slogans and surface-smoothing rationales which seldom have anything to do with their real causes.

An economic dispute might take hold in the public imagination as a “good-vs-evil” struggle. Land disputes might persist for generations as holy wars (not naming any names here). Resource shortages might be difficult to sell as an outright casus belli; but, say, the sinking of a merchant ship… well that should move the population’s blood to a nice war-fueling boil.

Though it might seem to many like something of a historical obscurity, and one the United States might like to forget, mid-20th century Guatemalan President Jacob Árbenz learned via coup d'état that disrupting overseas business with a stronger hemispheric cohabitator can be repaid via unforgiving backlash. The strong-willed Árbenz favored a restructuring of his country’s agricultural interests, specifically those that intersected with the business dealings of the United Fruit Company (UFC, which is now Chiquita), an American business of enormous size, historically associated with banana harvesting… and meddling in the sociopolitical affairs of banana-growing nations. Most people know the term “banana republic”, even if some may not know of its origins. Keep tuning in for more knowledge just like this.

Source: Wikimedia Commons

The UFC wielded extraordinary influence both within the United States and in the tropical lands of Central America. Árbenz’s efforts, though understandable as being for the ostensible betterment of his country, were unacceptable to the economic interests of the U.S. His being removed from power in 1954, after a three-year run as president, was the direct result of the UFC’s persuasion of President Eisenhower (and the CIA, more pointedly).

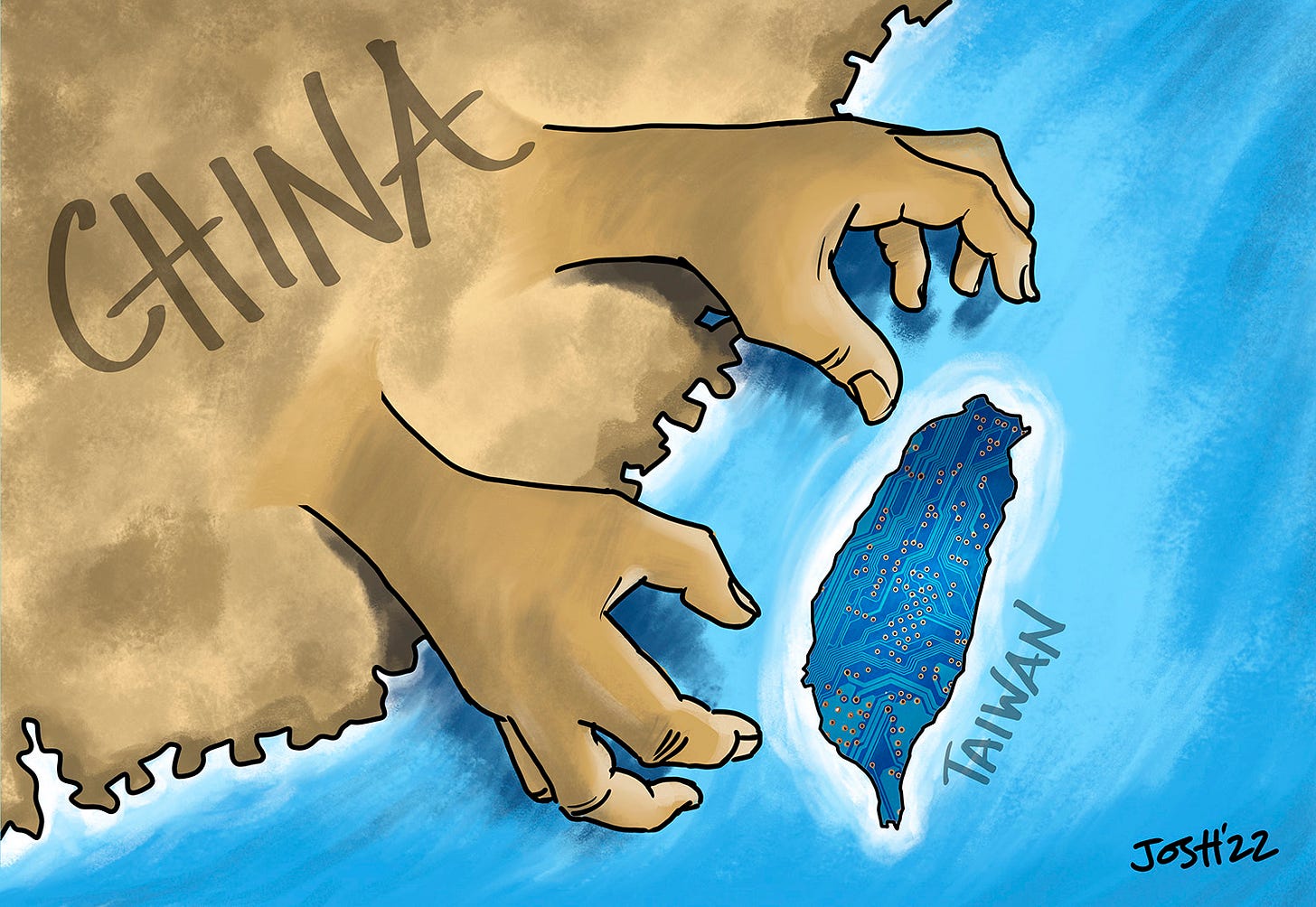

With that topical framing stated, let’s pivot from the U.S. and Central America to the Chinese Communist Party (CCP) and the Republic of China (ROC/Taiwan). And, more specifically, from farming and fruit exports to bottlenecked tech manufacturing and semiconductors.

You see, Taiwan finds itself in a strange historical scenario, and long has. Their existence is simultaneously an affront to Chinese (CCP, really) solidarity, and a statement on the extraordinary nature of Western values, free-market success, and cultural adaptability. The second of these, free-market success, has manifested in numerous facets of the small island nation’s flourishing economy, but perhaps nowhere more so than in the country’s namesake semiconductor manufacturer: Taiwan Semiconductor Manufacturing Company (TSMC), upon which many major Western corporations are dependent, including Apple.

The economics of this topic are explored in Chapter 8 of the Haymaker’s recently published Bubble 3.0, in which he advances an idea that’s gained considerable circulation in recent years: “The China trade war that started under Donald Trump, which denied Chinese tech companies access to critical American components such as semis, caused its government to launch a frantic effort to build its own semiconductor industry. One reason being floated for why China might invade Taiwan is to secure control over the most valuable and cutting-edge integrated circuit company in the world, Taiwan Semiconductor.”

With an ascendant, popular, and business savvy president disrupting the UFC’s system, the U.S. could claim Guatemala presented a threat to democracy within the western hemisphere. Based on the very existence of a deeply Western-aligned economy, the CCP can claim Taiwan is a rogue state and/or an insult to Chinese sovereignty, cohesion… take your pick. When international tensions simmer, look for platitudes on the water’s surface and for matters of substance in the undercurrent.

After reading a draft of this piece, Evergreen Gavekal Chief Economist, and close friend of the Haymaker, Louis-Vincent Gave offered astute insights and an admittedly different take on the topic. “The big problem with the idea that China will invade Taiwan for semiconductors is that the very minute China invades Taiwan, the semiconductors plants are destroyed… then no more semiconductors…

But I guess in this way China could make it that NEITHER the US nor China would then get access to semiconductors. But that doesn’t really work past 12 [months] because the best machines are made by ASML – who would sell machines to the US, but NO LONGER to China/Taiwan…”

Louis went on to identify an essential distinction that’s key to contextualizing my central analogy: “Bottom line is that semi plants are not oil wells or banana plantations… And their best assets take the elevator every day…”

Who can argue with that? I originally made the simple observation that Guatemala has bananas while Taiwan has semiconductors. But per Louis, the more useful summary would be that Guatemala grows bananas while Taiwan makes semiconductors — important distinction.

Even with Louis’ compelling point taken into account, there may be some additional utility to the analogy, one particularly detectable through a political lens.

President Biden’s recent remarks about defending Taiwanese sovereignty (readily “clarified” by a now well-practiced group of WH insiders), gives tensions in China’s immediate sphere a palpable quality, like the sort you might observe when recently mutually disdainful in-laws are in attendance at a holiday gathering – nobody’s sure what will happen, but the possibility alone is enough to create, well, let’s say unease. Now imagine one of the in-laws outweighs the other by 300 lbs… and has nukes. There, that’s the CCP/ROC scenario distilled. In-laws… and nukes. What a dispiriting image that verbal package conjures.

Source: Wikipedia

Now, we’ll say it here: China’s emotional investment in Taiwan is surely greater than America’s ever was in Guatemala. For one, the CCP views Taiwan as part of the Chinese whole; the U.S. has no such claim on Guatemala. Where the comparison is worthwhile is in recognizing, as argued above, that acts of aggression can be and often are justified on social grounds but are realistically and truthfully carried out for economic ones. Nations cannot ignore the hard facts any more than markets can do so, regardless of how craftily the narratives surrounding them are spun up and displayed to distract and satisfy the masses.

Russia’s invasion of Eastern Ukraine was perhaps a day or two underway before the inevitable (and obvious) China vs. Taiwan comparisons found their way into innumerable lines of media discourse. The general azimuth of said discourse has been predicated on the “rehearsal” concept; as though Shakespeare’s world-as-stage thesis applies to matters of international warfare, with China scrutinizing Western reaction(s) to Russian aggression so as to better gauge their own performance should their shot reclamation of Taiwan materialize.

Now, the fact is, one need only look to the African continent, to North Korea, and to less-than-stable regions of the Arabian Peninsula for examples of schism, factionalism, crimes against humanity, et cetera, all of which could (theoretically, if not ideally) warrant external intervention of different degrees. But the Ukraine/Russia dynamic comes with a multi-layered arrangement of factors that make such intervention more palpable.

First, a nominally democratic nation was threatened by an autocratic neighbor in seemingly anachronistic fashion; second, an enemy of the West made an unforced error rendering it vulnerable to an expensive proxy war. Regardless of the so-called realpolitik of the first item, the second of these was too good to pass up. And admittedly, said hopes of a thriving Ukrainian democracy have their place in the calculation, though we might do well to curtail unrealistic expectations, should the outcome differ from our ideals.

In the Far East, the differences lie partially in the scale (proxy war with China would prove too costly, too dangerous, too intensive, too everything) and partially in the fact that our economic ties and political common ground with Taiwan are much more established, more of a known quantity, more clearly understood. Ironically, the former makes intervention less viable, even if the latter makes it more defensible. Staging a coup over bananas is one thing; getting in the middle of a family feud to ensure Taiwan’s semiconductor output remains a net positive for the United States… well that’s a harder reality to mask behind a pro-freedom narrative.

What we’re seeing (or simply re-learning) with Ukrainian War coverage is that rhetoric can inform action, but to some degree, it operates in a separate sphere – commercials are meant to entice more than they inform. Propaganda is meant to stimulate instincts, not bolster rationality.

War is exciting and almost irresistible when it’s cheap. If it came with an upfront price tag of, say, $500 for every taxpayer, which is the exact sum Senator Rand Paul has suggested in recommending a “war tax” for Ukraine, that excitement would quickly abate, and war would just as quickly become quite resistible (as it always should be). Paul’s observation that we are “fine to sort of put it on the tab” is unassailable in its accuracy. Ukraine is bringing these realities to the forefront of American political discourse; perhaps their visibility will afford us the benefit of wisdom should CCP-ROC hostilities manifest.

Ultimately, recent international plights have forced us to confront much of what we once knew about the fragility of supply lines, the limits of military might, and the political calculations that follow on any proxy war. This ancient and immutable knowledge, now readily resurfaced, might be of value to our presently waning republic should the worst materialize with the CCP/ROC situation.

We need not look to the shores and lands of faraway nation-states to find meaning in our own lives. No matter our taste for cheap bananas or reliance on semiconductor manufacturing, Western wealth should be dispensed cautiously and with clarified purpose, not carelessly and with misrepresented sloganeering guiding the conversation. There will be challenges aplenty down the road, and, for that matter, there is plenty to deal with right now. As I don’t have all the answers, maybe none, just remember that no banana was ever worth a coup (except perhaps a blue java, which is purported to have a bit of a vanilla taste to it).

Source: Wikimedia Commons (Yes, I’d consider staging a coup over a bunch or two of these. A bloodless coup, of course.)

A Word From The Haymaker’s Corner

Our readers have been helping out greatly with plenty of “Likes” and insightful commentary on our work. We thank you for that and will always eagerly check out what you have to say. And if you’re loving the Haymaker’s content enough to regularly visit us ringside, we invite you to become a subscriber (if you aren’t one already) and hope you’ll share the content with any friends who might enjoy weekly thoughts on markets, banks, commodities, politics, and more.

There’s that bell once again. The fight continues.

"Western wealth should be dispensed cautiously and with clarified purpose, not carelessly and with misrepresented sloganeering guiding the conversation."

Another pearl David. It is sad that our 'leaders' cannot see and act on the wisdom in this statement.

Wow, you need a talented editor. This may have been proofed by "yes" men & women. Your critical thinking is misty. I read this because of Grant Williams' recommendation of you via Twitter.